The surplus of spuds created by the COVID 19 pandemic closures will affect the potato market well into the fall.

The COVID-19 pandemic significantly impacted the Canadian potato market, with fresh potato sales taking off while the service industry closures caused french fry demand to plunge. While demand is starting to rebound, the pandemic effects will continue to be felt for months.

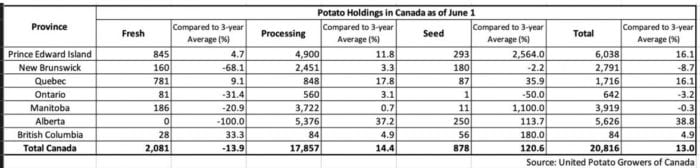

Potato holdings figures released in June by the United Potato Growers of Canada (UPGC) provided a clear picture of the lasting effect of the COVID-19 pandemic.

Fresh potato stocks were down 13.9 per cent on June 1 from the previous three-year average. Processing potato stocks, on the other hand, increased by almost the same amount — 14.4 per cent — while seed potato holdings were up a whopping 120.6 per cent.

The UPGC pegged the total potato storage holdings in Canada at 20.8 million hundredweight on June 1, up 13.0 per cent from the previous three-year average.

In the United States, figures released by the U.S. Department of Agriculture showed total potato stocks were at 67 million hundredweight on June 1 — a four per cent drop from the 70.4 million hundredweight of potatoes in storage last year.

Kevin MacIsaac, general manager of the UPGC, told Spud Smart in mid-June he expects the surplus of processing spuds in Canada caused by COVID-19 to affect potato deliveries this fall.

“We basically have July and the middle part of August for what we would normally consider to be usage of old crop potatoes to make french fries. Normally, the factories would start taking new crops around the end of August, certainly by Sept. 1, and arrange out-of-field deliveries,” MacIsaac says.

“A lot of the factories have advised growers that on the processing side, that they are not going to be able to take the out-of-field deliveries to the level that they used to, because they expect there’s still going to be using old crop out of the storages until September or perhaps even October.”

According to MacIsaac, french fry sales to food service outlets dropped more than 50 per cent in Canada at the start of the pandemic. There was a gradual improvement after that, but as of mid-June, sales were still down 25 to 30 per cent from compared to last year.

“We think it’ll come back reasonably well. I think the big unknown for is in the industry is at what level will it come back to,” said MacIsaac.

Unsurprisingly, export sales of frozen potato products took a big hit at the start of pandemic.

“Much of our export goes to places like China and Japan, and it takes a while for those countries to come back as well,” McIsaac explains. “Exports have been slow and will continue to be slow, but it’s on the right side of the curve.”

MacIsaac notes the news wasn’t all bad for the processing sector during the pandemic. Grocery store sales of frozen potato products jumped substantially, and chip sales were also strong as people stayed at home to consume their favourite potato snacks.

According to MacIsaac, fresh potato sales in Canada rose by as much as 55 per cent at the start of the pandemic. As of mid-June, they were still up by 15 per cent from the same time in 2019.

Interviewed in mid-June, Missouri-based Rabobank analyst Stephen Nicholson, says the potato market trends in the U.S. closely resemble those in Canada during the pandemic.

“We’re still seeing good demand at the retail level for table potatoes and frozen potato products,” he says. Nicholson notes in some areas, processing acres were slashed by as much as 50 per cent as a result of contracting cuts.

French fry sales are slowly bouncing back as restaurants and other food service venues reopen, Nicholson says. However, there is still a great amount of uncertainty surrounding future demand.