Potato growers in the United States will plant 7,000 fewer acres this year, the March 31 issue of the North American Potato Market News (NAPM) says. At 936,000 acres, this year’s planted area would be down 0.7 per cent from the 2021 crop — with growers in Idaho, Michigan, Oregon, and Wisconsin all planting less.

NAPM notes that if U.S. potato growers have average growing conditions the 2022 crop could still be the largest produced since 2018. Production is estimated at 430 million cwt of potatoes — five per cent above 2021 production.

In the Columbia Basin, processing contract volumes are larger this year in order to supply season processing potatoes. NAPM expects some acres are likely to switch from table to processing potatoes.

Chip contract volumes are down substantially this year, the report notes. The main force behind this is due to reduced acreage in Michigan, Wisconsin and Florida. However, other states, not reported by U.S. Department of Agriculture, may have reduced chip potato acreage, including North Carolina, Illinois, Missouri, and Virginia.

The report says Russet table potato supplies are likely to rebound this year, while acreage will remain mostly flat. Yields are expected to return to normal levels and there’s expected to be less open market demand from processors for potatoes.

“Finally, switching from Russet Burbanks to Russet Norkotahs is expected to continue in Idaho, which could further increase table potato supplies,” the report says.

Yellow potato acreage is expected to increase while red will fall. NAPM notes demand for yellow potatoes is continuing to grow and prices both red and yellow potatoes has been stronger this year.

The report says fresh shippers will likely face some resistance when it comes to increasing prices for the 2022 crop. If yields rebound there may be a much larger crop for fresh shippers to buy.

“If shippers are unable to increase potato prices, with general food inflation and rising production costs, growers could receive prices well below breakeven levels.”

Seed potato acreage will remain stable but there’ll be shifts amongst varieties grown, the report says. Seed for processing varieties appears to be limited in some areas, while chip seed has been turned back to growers, due to contract reductions.

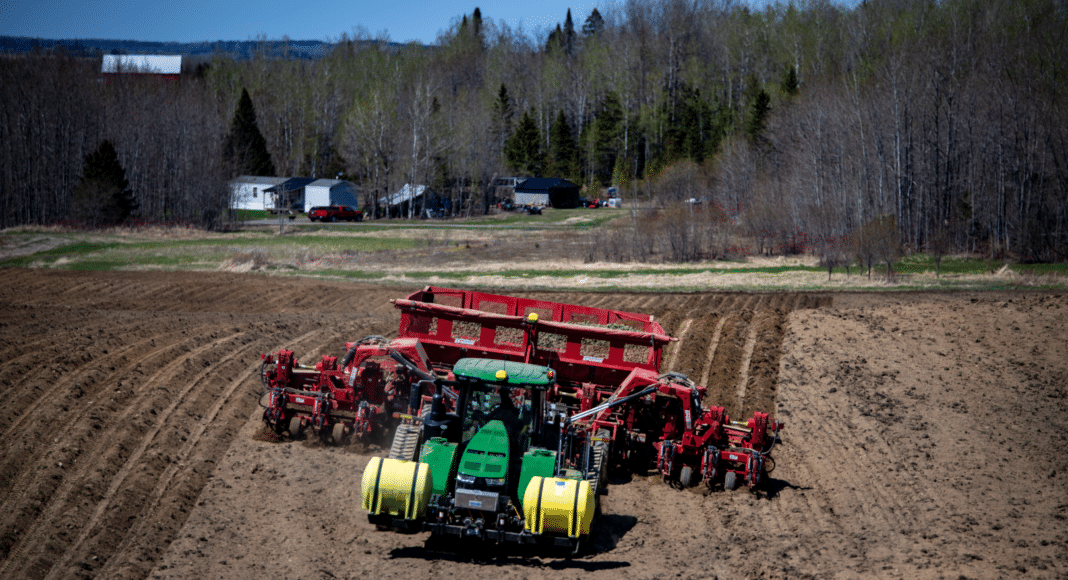

The report says growers are showing little appetite to increase potato acreage despite current strong prices. The 2022 potato crop will be the most expensive crop ever planted in the U.S. — skyrocketing input costs over the past two years have increased the grower’s financial risk and capital requirements significantly.

Related Articles

Sales of Frozen Potato Products on the Rise for 2022

Rising Input Prices Weigh on Potato Growers

North American Processing Contract Negotiations at Standstill